European Pickup Trucks Market Share: Future Outlook

Over 25% of the greenhouse gas emissions in the european pickup trucks market share caused by the transport sector. Nonetheless, the shift to zero-emission transportation is already well under way in the commercial vehicle market.

By putting a lot of effort into electrifying their vehicles, domestic automakers are supporting this initiative. Zero-emission vehicles (ZEVs) have already been introduced by the majority for various business uses.

Insights into the European Pickup Trucks Market Dynamics

But there's a stronger need to speed up this shift. The European Commission raised the CO2 emissions reduction targets for heavy-duty commercial vehicles in February 2024. It is required that levels be 45% lower in 2030 than they were in 2019, 65% lower in 2035, and 90% lower in 2040.

The creation of national strategy frameworks that carry out EU legislation on the growth of the bloc's hydrogen and charging infrastructure supports the market.

Read Also: HK jails European citizen for 'demonising China'

MDVs are in the forefront.

The medium-duty van (MDV) category comprises the bulk of ZEVs in the medium and heavy-duty vehicle market in terms of principal application. This accounts for 48% of deliveries with zero emissions and is composed of panel vans weighing more than 3.5 tonnes gross vehicle weight (GVW).

Market share of new medium-truck EV registrations in the EU

A good beginning

The market for medium-duty electric models continued to expand in the first quarter of 2024. The market has had a 2% increase in volume compared to the same time in 2023. Nevertheless, the market share has decreased; the three-month number is 7.7%, which is 0.4 points lower than it was a year ago.

Top-selling EV medium-truck brands in the EU based on market share

Strong growth

Electric trucks with GVWs above 16 tonnes accounted for 1% of the heavy-duty market in 2023, up 0.6 percentage points from the previous year.

With a 61% market share in 2023, Volvo Truck Group maintained its position as the industry leader in the electric heavy-duty sector. Volkswagen (VW) Group won 10% of the market, followed by Daimler Truck Group with 11%.

Volvo Truck Group's robust electrified portfolio contributed to its advantage. The firm provides consumers with the well-liked Renault D and T series in addition to the Volvo FE, FL, FH, FM, and FMX. In the meanwhile, Daimler Truck introduced the eActros, eAtego, and eEconic, which are mostly used for garbage collection. Lastly, the MAN eTGM and eTGX as well as the Scania G/L/P/R/S series are available to the VW Group.

Must Read: ‘Tone-deaf’ fossil gas growth in Europe is speeding climate crisis, say activists

Top-selling EV heavy-truck brands in the EU based on market share

Extension of fuel cells

As european pickup trucks market share moves toward zero-emission transportation, hydrogen fuel-cell technology is a viable way to increase the range of heavy-duty vehicles. Although electric vehicles have a 330-kilometer range on a single charge, batteries with a 550-kilometer range are unlikely to hit the market before 2026.

Hyundai's Xcient FCEV dominates the fuel-cell electric vehicle (FCEV) market in Europe. By the end of 2024, 150 units will have been supplied, with Germany probably being their largest market. But, among other nations, Switzerland will also get a large number of units.

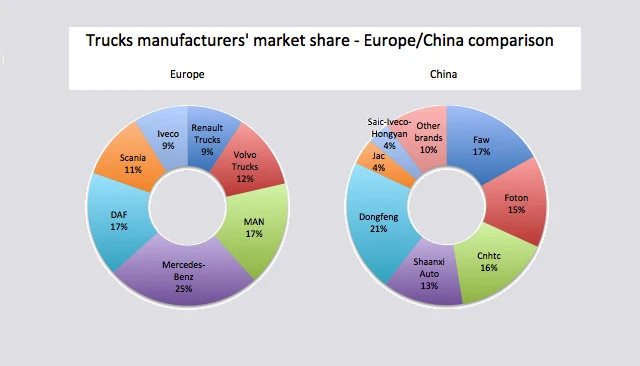

All things considered, it is evident that the market for medium- and heavy-duty commercial vehicles is becoming more electrified, both in terms of fleet acquisitions and manufacturer advancements. European domestic producers continue to dominate the industry, but the possibility of Chinese companies entering the market and concentrating on the medium category might change the landscape in the future.