How much equity should founders have at exit?

The worth of ways out for European new businesses plunged almost 30% in 2023 in the midst of progressing macroeconomic vulnerability and a 10-year low in open postings, as per another report from PitchBook.

The typical exit for new companies in 2023 got started at €23m, 28.7% lower than in 2022. Those that happened were driven by acquisitions as opposed to public postings, the complete worth of which was €1.4 billion out of 2023, the most reduced in 10 years and 90.2% lower than a year sooner.

For pioneers, this harder leave climate implies that supervisory groups should expand interior money runways or assume obligation or follow-on adjusts to make due, Navina Rajan, senior EMEA private capital examiner at PitchBook, tells Filtered.

"We think the previous is more normal, where a few prominent and more modest organizations have begun cost-scaling cycles to downsize overheads, cash consume and increment benefit.

"As frequently is the situation with harder market climate, we see a combination of business sectors where unrewarding and impractical organizations fail or are purchased out. We have seen instances of this and expect more justification could happen. We have likewise seen an increase in action in auxiliary business sectors."

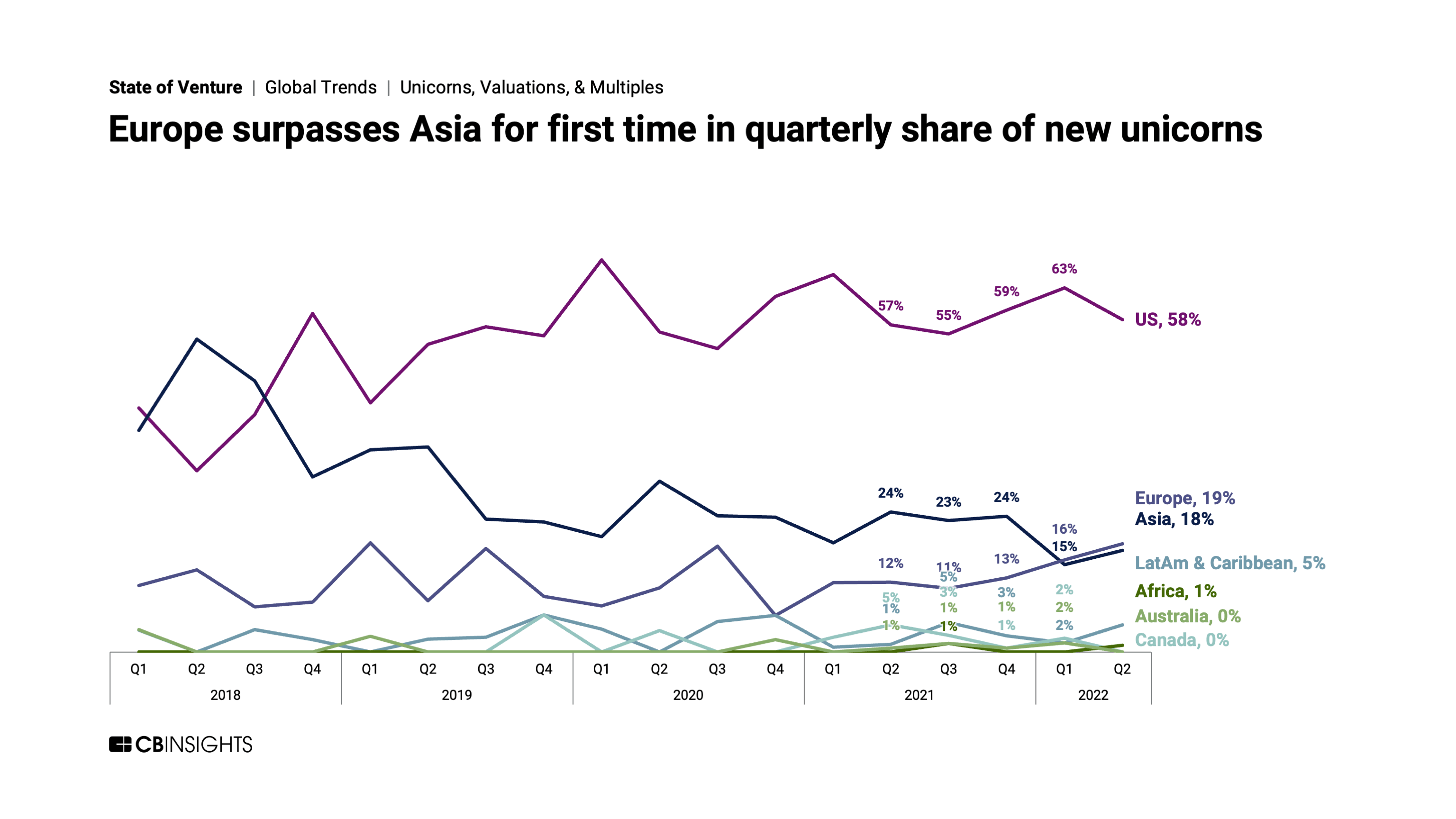

The absence of leave amazing open doors is hitting European unicorns, the report found, with additional redundancies expected during 2024. A sum of 12 unicorns were printed on the landmass last year, six left business and two lost their $1bn valuations in the wake of subsidizing adjusts.

Lack of exits hitting European unicorns

Portion of dynamic European unicorns somewhere in the range of 2013 and 2023 by industry

Downrounds on the up

Downrounds made up 21.3% of complete gathering pledges bargains in 2023, up from 14.4% in 2022. Looking forward, examiners foresee that a rising number of new businesses should seek after down adjusts in 2024 — and that they will be progressively hesitant to discuss them.

Tourist investors flee

In the mean time, the contemporary financial backers that climbed into VC in 2021 and mid 2022 have kept on escaping the market. The report found that forward thinking financial backers made up 43.5% of absolute VC subsidizing in 2023, the least level beginning around 2015.

AI caramba

Probably the biggest arrangements in 2023 involved simulated intelligence organizations — Aleph Alpha and Mistral simulated intelligence both raised €400m or more — while environment tech H2 Green Steel raised €1.5bn.

Yet, the man-made intelligence publicity has not converted into a general expansion in valuations for artificial intelligence new companies. 2023 saw just minor expansions in seed and pre-seed valuations, while post Series A valuations divided. With regards to simulated intelligence, a rising tide has up until this point not lifted all boats.