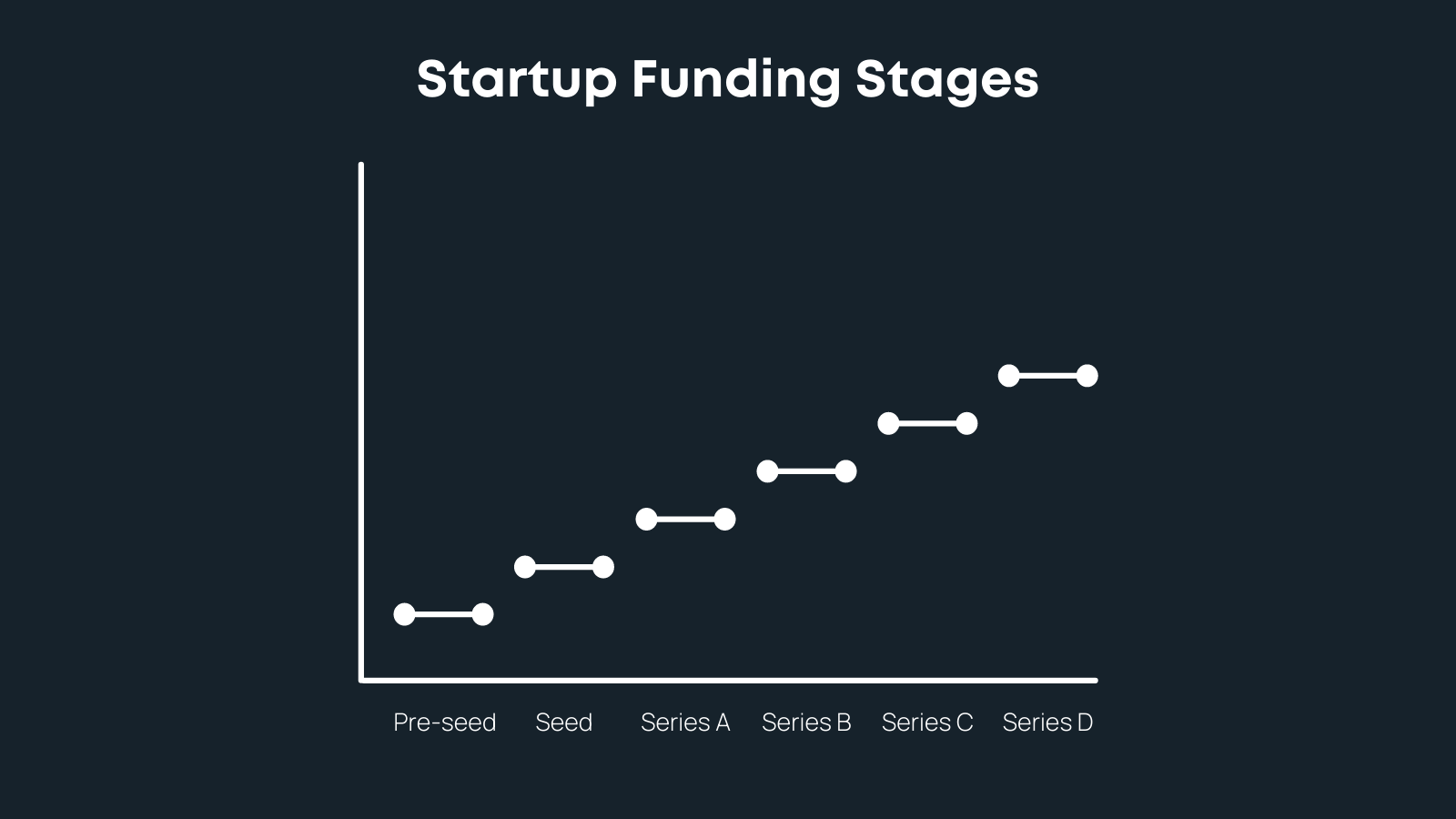

Startup Funding Stages: From Seed to Exit

Albeit fostering an exhilarating business idea and utilizing it to construct an organization seems like a well conceived plan, it's significant not to leave a productive work and vocation in quest for large cash presently. Hopeful business visionaries who need to take a shot at the business world ought to initially carve out opportunity to find out about the different startup subsidizing stages.

Investigate how to fund your new pursuit from when you concoct a suitable plan to the exit. Without this critical asset, your organization may not endure past an underlying two or three years. Securing important data can have a definitive effect in getting subsidizing at each phase of your endeavor. Furthermore, guaranteeing its drawn out progress.

Before the Pre-Seed Stage

Like effective sequential business visionaries will prompt you, another business begins with a revelation stage. Right now, you're exploring the market, likely issues, and item thoughts that can be potential arrangements.

You'll interface with clients and control gatherings to test in the event that your thought merits chasing after. This exploration is achieved with at least cash. Best case scenario, pioneers put time and sweat value into understanding what can and can't work.

Pre-Seed Funding Stage

When you're sure about an extraordinary item thought, the following stage in the startup subsidizing stages is rejuvenating it. In the pre-seed or bootstrapping financing stage, pioneers put their cash into fostering a reasonable item model.

Having some dog in the fight is a strong inspiration to make the endeavor work. At the point when you're prepared to move toward financial backers for subsidizing, they will see the value in your obligation to the undertaking. Numerous business visionaries make additionally require up second responsibilities to help their thoughts.

As well as sinking your reserve funds, you'll contact loved ones for help in the beginning phases. Additionally, interface with partners and other casual wellsprings of money, for example, crowdfunding stages.

More than the business thought, your companions will put resources into you and their trust in your capacities. You'll secure the cash you want without undermining your control of the organization activities or the apprehension about weakening. However there are no decent straightforward appraisals, business visionaries can hope to raise somewhere in the range of $100K to $5M.

Formal Pre-Seed Funding Entities

:max_bytes(150000):strip_icc()/shutterstock_174416492-5bfc365c46e0fb0051c00a44.jpg)

Other sources of financial support you can approach incorporate channels like startup hatcheries, private backers, and gas pedal projects. Startup hatcheries and gas pedal projects do substantially more than simply store the startup, they offer added help through framework and tutoring to help you in building an item model.

When you're prepared to leave the program, you'll leave with the chance to move toward other financial backer organizations. You'll likewise prepare in pitching to industry-explicit subsidizing elements and level up your show abilities for "demo day."

Most organizers have sufficient cash in the bank to see them arrive at additional startup subsidizing stages. The most basic variable is approval that the business thought merits backing. Getting to funding down the line turns out to be considerably more available and essentially depends on the organization's presentation. For this reason the pre-seed financing stage is much of the time called the approval stage.

Seed Funding Stage

Assuming you've arrived at the pre-seed subsidizing stage, you have sufficient cash to set up the endeavor. While you have an item model or MVP, you should foster the plan of action and go-to-showcase system. At these startup subsidizing stages, you'll require cash to send off the item and put resources into promoting and publicizing endeavors.

You'll employ extraordinary ability and ranges of abilities and construct an establishing group to send off the organization. Additionally, complete the essential exploration on the item market fit, and work out unmistakable expectations and achievements. Business people prepared to begin advertising their items need an underlying infusion of capital however are yet to produce incomes.

Be that as it may, you can hope to draw in speculations from financial speculators, pre-deals incomes, obligation supporting, and private backers. At this stage, you might need to draw up agreements and layout the agreements for reimbursement.

Beside an offer in the organization benefits, financial backers might require value in the new organization as opposed to subsidizing. Likewise, hope to surrender explicit privileges on the off chance that the financial backers offer direction and specialized skill. You should acknowledge this help since it can possibly launch the endeavor.

Series A Funding Stage

Series A subsidizing is normally the main funding supporting round, however the organization may not make a lot of income. At this point, you ought to have a Base Suitable Item and a client base and be prepared to create deals.

You'll open the organization to financial backers and give a valuation and estimating. Commonly, Series A startup subsidizing stages result in $15 at least million money infusions. When you fund-raise, you're prepared to scale the business across more extensive business sectors.

While getting ready for the Series A financing round, you ought to be prepared with a drawn out strategy for predictable benefits. You can likewise contact past financial backers to take part in the following round, and master business visionaries suggest you go with the 31-10-2 rule.

List around 30 financial backers who could propose to support, yet expect just ten will probably show any real interest. Just 2 of the finalten0 will infuse financing into your startup. Planning for the Series A round well before you want more cash to scale the endeavor is likewise prudent.

Financial backer Measures and Business person Assumptions

Most financial backers center around measures like a hearty business methodology that might possibly change over the thought into benefits. Different variables might incorporate size, establishing group, amazing unit financial matters, risk elements, execution, and gifted administration.

Procuring your most memorable genuine financial backer ordinarily makes way for drawing in other top agents who'll show interest in your organization. Consider substances like super private supporters. In any case, additionally hope to offer favored stock rather than the subsidizing you get. Keep in mind, agents wish to buy around 10% to 30% of the organization.

When you complete this startup financing stage, your organization ought to have satisfactory turning out capital for six to year and a half. While assessing the sum you really want to raise, work out the amount you'll have to meet your targets before it's the ideal opportunity for the following round.

Series B Funding Stage

Organizations going through startup financing stages are prepared for Series B when they have a hearty client base and a guaranteed income stream. At the point when you're prepared for financing to extend further, you'll start a valuation to raise the Series B stage. Commonly, financial speculators and later-stage VCs put resources into Series B.

These financial backers have seen your endeavor's presentation and are sure of its prosperity and adaptability. Apparently, this subsidizing round isn't exactly particular from the ones you've executed previously. The basic contrast is that you'll raise supporting from financial backers who bank on more seasoned, laid out new businesses with lower risk. Simultaneously, you'll have really arranging power.

Business people redirect the subsidizing they gain toward quick development to fulfill client assumptions and needs. You'll increase exercises to overwhelm the opposition and increment your portion of the overall industry. Adroit originators and experienced financial backers comprehend the worth of gifted establishing groups.

In spite of the fact that you have a fantastic group, the Series B subsidizing will assist you with extending your required ability. You can add functional abilities like promoting, publicizing, and business advancement.

Utilizing the assets, you can settle the organization and scale to catch new business sectors while managing progressing, momentary difficulties. Be that as it may, get ready for the weakening of the organization with startup financing stages.

Series C Funding Stage

Business visionaries considering Series C financing run prospering organizations that are flourishing and excelling on the development way. Your goal behind more money is to explore and ideate new product offerings and administrations.

You'll need to catch new business sectors, adventure into comparable ventures, and maybe, obtain more modest new companies. You're prepared to purchase out contending organizations, and your organization is clearly beyond the startup stage. Finding the money for each new task is a cakewalk.

Since you've conquered the gamble factor, more financial backers will be arranged to put resources into your organization. These elements might incorporate speculation banks, confidential value firms, multifaceted investments, and so on.

You may likewise have new and arising financial backers offering finance since they like to follow driving financial backers. They'll back winning brands with a long history of extraordinary execution, achievement, and productivity. Your organization needs a powerful client base and demonstrated and stable incomes to get Series C subsidizing. Worldwide extension and markets are additionally standards.

Series D Funding Stage

Most organizations don't arrive at the Series D subsidizing stage. Or on the other hand, they may not advance to Series E, F, or further. Business visionaries pitching for more money regularly see a fabulous, not-to-be-botched an open door with the potential for rich returns. They might investigate this choice prior to taking the organization public with an Initial public offering.

On the other hand, the organization might have missed gathering its goals for the Series D round. The pioneers might decide to get more cash to achieve what they set off on a mission to do. On the other hand, you might pick to get more financing prior to going into a consolidation with a contending organization.

Likewise with other startup financing stages, you'll have the organization esteemed prior to contacting financial backers. At this stage, organizations normally esteem $150 million to $300 million, holding back nothing $100 at least million.

The most suitable choices for Series D financing are late-stage VCs, venture banks, confidential value firms, and speculative stock investments. Be that as it may, realize your organization might have a brought valuation in the event that you maintain that down should raise cash-flow to meet incomplete objectives. This element could shake financial backer certainty and make